We’re in the midst of a major economic transition, one that may eventually match the changes of the Industrial Revolution. The change, of course, is the advent of the green economy, and the switch from fossil fuel energy sources to renewable energy. While wind and solar power are soaking up the headlines, a more plausible long-term green power source is already near at hand: hydrogen.

Hydrogen is the most abundant of all the chemical elements, and also the simplest by molecular structure. It is found everywhere; with carbon and oxygen, it forms the basis of the organic compounds that make life possible, and in the heart of the sun, its nuclear fusion generates the light and energy on which we all depend. Without hydrogen, we couldn’t exist.

Hydrogen also offers high potential as fuel. It is highly reactive, and amenable to our technological control. As a fuel, it can be burned with oxygen to release both light and heat; as an element in fuel cells, it can generate clean electricity. Being so common, relatively simple technological processes – electrolysis powered from renewable sources and steam methane reforming associated with carbon capture and storage, to produce ‘green’ and ‘blue’ hydrogen respectively – can produce hydrogen at scale for industry and utilities.

A recent report from Deutsche Bank’s David Begleiter points out that, due to recent initiatives of the Biden Administration, it pays for companies to produce clean hydrogen. The Department of Energy has announced $7 billion in funding for regional clean hydrogen hubs in the US, and the US government is working to promote demand for clean hydrogen.

Begleiter, a 5-star analyst, has also been pointing out stocks that stand to gain as hydrogen use expands. We’ve used the TipRanks platform to look up the details on two of those picks, producers and distributors of industrial gasses, that are leaders in the sector – and that investors should watch them closely.

Linde plc (LIN)

Linde, the first company we’re looking at, was founded in Germany and traces its roots back to 1879. Today, the firm operates with a global footprint and has become the leading provider of atmospheric gases – argon, nitrogen, and oxygen – for industrial use, as well as other pure gases such as hydrogen, carbon monoxide, ammonia, and methanol. The company’s products have found uses in aquaculture, agriculture, chemistry, construction, electronics, healthcare; there is hardly a sector of our economy that does not make use of gases in some way.

All of this isn’t just big business, it is huge. Linde has a market cap of $185 billion and generated over $33 billion in total revenues last year. Its gas business is supplemented by engineering services, in separating and pressurizing gases, developing and building systems for the liquefaction and storage of gases, thermal processes for recovering gases from industrial feedstocks, and developing the specialist equipment for the manufacture of industrial gases.

When it comes to hydrogen, Linde has the long-term experience, the technical expertise, and the existing infrastructure to rapidly generate the gas in large quantities, to store it safely, and to ship it when and where it is needed. Linde already provides hydrogen for several industrial applications, including aviation, heavy industry, mobility, and power buffering.

Linde’s oversized footprint in the industrial gas niche has been beneficial for both the company and its investors. Earnings are trending upward in recent quarters, and the firm’s stock is up 18% year-to-date. In its last quarterly financial release, for 2Q23, Linde showed an adjusted EPS of $3.57, beating the forecast by 9 cents and growing 15% from the prior-year quarter. The top-line result, however, was down ~5% year-over-year and missed the estimates by $500 million.

For analyst Begleiter, all of this can be summed up in a simple list of achievements: “With Linde executing well on pricing and productivity, 18 consecutive earnings beats, a highly resilient business model, a $50B-plus and growing slate of clean energy investment opportunities and valuation a fair 27.0x ’23E EPS and 16.6x ’23E EBITDA, we reiterate our Buy rating.”

That Buy rating comes along with a $450 price target suggesting ~19% one-year upside potential for the stock. (To watch Begleiter’s track record, click here)

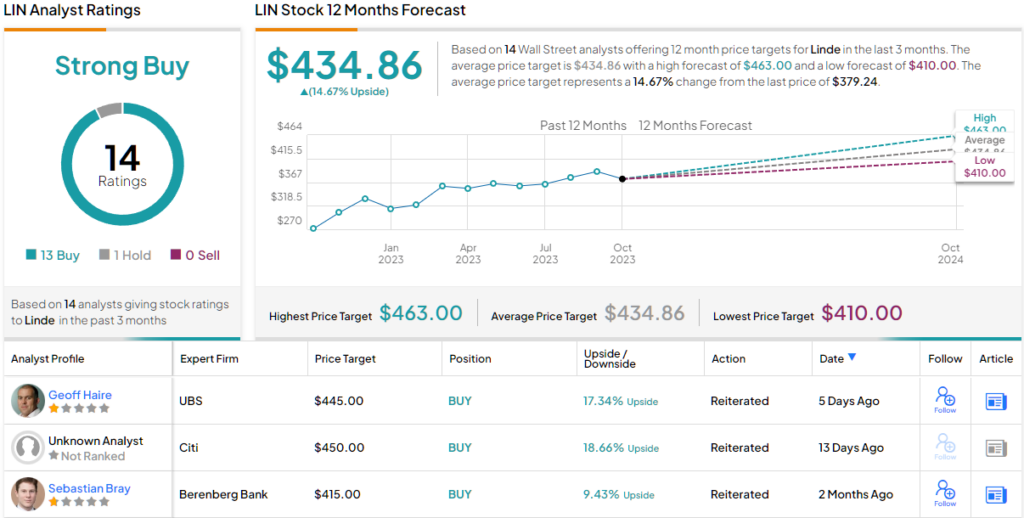

Overall, Linde gets a Strong Buy consensus rating from the Street’s analysts, supported by a decisive 13 to 1 Buy-over-Hold margin among the 14 analyst reviews on record. The shares are trading for $379.24, and the $434.86 average target price points toward ~15% upside on the one-year horizon. (See Linde stock forecast)

Air Products and Chemicals (APD)

Next up is Air Products and Chemicals, a Pennsylvania-based industrial gas firm. Like Linde above, Air Products provides a wide range of gases, including hydrogen, helium, carbon monoxide, and carbon dioxide, as well as the common atmospheric gases argon, nitrogen, and oxygen, along with the engineering and storage expertise to use them efficiently. The company’s products are found across the economy, in electronics, food and beverage, cement and lime, pulp and paper, rubber and plastics, food and medicine – the list is nearly endless.

By the numbers, Air Products has an impressive footprint. The company operates in over 50 countries, employing more than 21,000 people to serve over 200,000 industrial customers. APD generates its products in a network of 750+ facilities and can transport gases through 1,800 miles of pipelines. The company posted $12.7 billion in sales for fiscal year 2022 and has ~$64 billion market cap.

Earlier this year, Air Products announced that it had ‘closed the deal’ on an agreement with two partners, ACWA Power and NEOM Green Hydrogen, in the development of the world’s largest green hydrogen production facility. Air Products and NEOM concluded contracts worth $6.7 billion for engineering, procurement, and construction activities in the project.

This announcement was only the latest in Air Products’ hydrogen activities. The company is deeply connected to the North American green hydrogen industry as part of its work to create a decarbonized economy.

Air Products reported its results for Q3 of the fiscal year 2023 in early August, showing revenue of $3.03 billion. This was down 5% year-on-year and came in $260 million below expectations. However, the company’s bottom line was stronger. Earnings have been rising gradually over the past several quarters, and the fiscal Q3 2023 bottom line was $2.98, up 13.7% from fiscal Q3 2022 and 7 cents better than had been anticipated.

Once again, we’re looking at a gas stock that Deutsche Bank’s David Begleiter sees in a generally bullish position. The analyst writes of Air Products, “With a large, green (blue/green hydrogen, carbon capture, SAF) and project backlog underpinning Air Products’ energy transition growth strategy and providing a line of sight to 10%-plus EPS growth over the next 5 years, a growing track record of large project execution and valuation a fair 22.3x ’24E EPS, we reiterate our Buy rating.”

Looking ahead, Begleiter gives the shares a price target of $330 to go along with the Buy rating, implying a 15% potential gain in the coming year.

Zooming out, we find that Air Products shares get a Moderate Buy consensus from the Street, based on 7 reviews that break down to 4 Buys and 3 Holds. The stock’s average price target of $328.71 suggests a gain of 14.5% from the current selling price of $287.12. (See APD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.