Wanting forward, 2020 is projected to be a robust 12 months for homeownership. In keeping with the Freddie Mac Forecast,

“We count on charges to stay low, falling to a yearly common of three.8% in 2020.”

When you’re at present renting, 2020 could also be a good time to consider making a soar into homeownership whereas mortgage charges are low.

As famous in the Nationwide Lease Report,

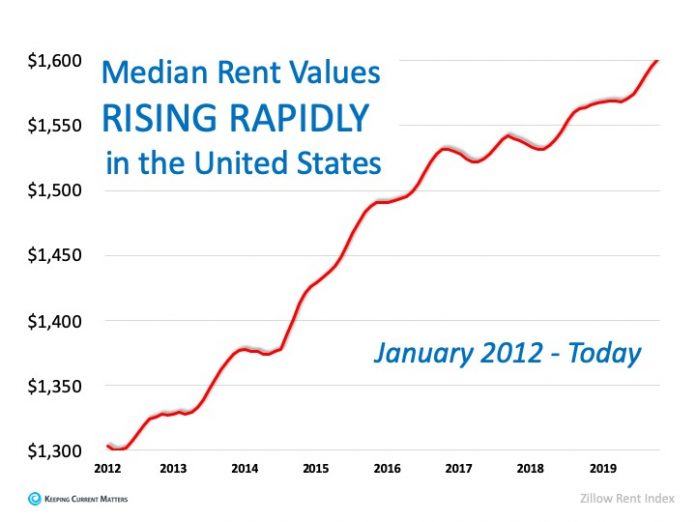

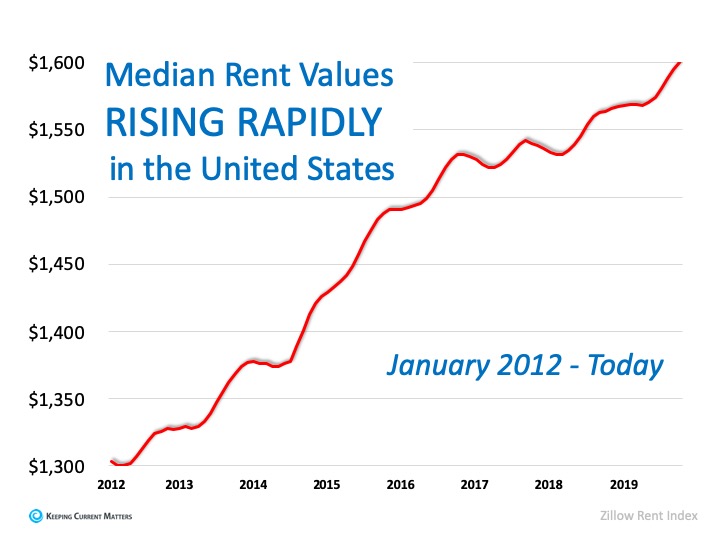

“the nationwide hire index elevated by 1.Four p.c year-over-year.”

With common rents on the rise, this year-over-year improve could not sound like a lot, however it may add up – quick. The mathematics on how a lot further it’ll price you over time absolutely doesn’t lie.

Right here’s an instance: On a $1,500 rental cost, a rise of 1.4% provides a further $21 {dollars} per 30 days to your cost. When multiplied by the twelve months in a 12 months, it’s a $252 total annual improve. The value continues to multiply if you hire 12 months after 12 months, as rental costs rise.

Historical past exhibits how common rental costs have been rising every year, and there doesn’t appear to be a lot finish in sight. Right here’s a take a look at how rents have grown since 2012 alone: Why not lock down your month-to-month housing expense, and at the similar time construct further web price for you and your loved ones? When you’re occupied with shopping for a house, contemplate the monetary advantages of what homeownership can do for you, particularly whereas the market situations are sturdy and present mortgage charges are low.

Why not lock down your month-to-month housing expense, and at the similar time construct further web price for you and your loved ones? When you’re occupied with shopping for a house, contemplate the monetary advantages of what homeownership can do for you, particularly whereas the market situations are sturdy and present mortgage charges are low.

Backside Line

With common rents persevering with to rise, now could also be a good time to stabilize your month-to-month cost by changing into a house owner and locking right into a low mortgage fee. Attain out to an area actual property skilled to find out how benefiting from the present market situations would possibly be just right for you.